How to Trade February Nonfarm Payroll News?

The Euro (EUR) extended upside movement against the US Dollar (USD) last week, rallying the price of EUR/USD to more than 1.0700 and leaving another bullish candle on the weekly chart. The technical bias remains bearish in short to medium term because of a lower low in the recent downside wave.

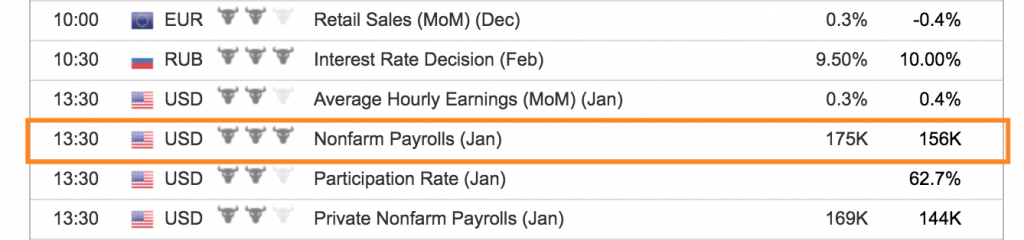

Not to mention, the Nonfarm Payroll report in economic calendar is scheduled for release on the upcoming Friday, the 3rd of February.

Technical Outlook

As of this writing, the pair is being traded near 1.0789. A hurdle may be noted around 1.0910 (the short term horizontal resistance area) ahead of 1.1232 (the trendline resistance) as demonstrated in the given below weekly chart. A break above the 1.1232 resistance shall incite renewed buying interest, validating a move towards 1.1714 (the high of August 2015).

On the downside, the pair is likely to find a support around 1.0340 (the low of January 3rd) ahead of 0.9636 (a horizontal support level) and then 0.8240 (the low of September 2000). The technical bias shall remain bearish as long as the 1.1616 resistance is intact.

How EUR/USD Reacted to Last Month’s NFP News?

Last month’s NFP report was released on 6th January. Economist had predicted 178k new jobs for the month of December whereas the actual figure came out to be 156k – missing the average forecast by a long shot. The EUR/USD inched higher initially after the last month’s NFP release but gave up all gains later in the New York evening session and closed in negative territory amid Hawkish Fed monetary policy outlook.

How to Trade February Nonfarm Payroll News?

The US Bureau of Labor Statistics will release the Nonfarm Payroll report on February 3rd. According to the median projection of different economists, the payrolls are expected to be around 157.2k to 158k for January as compared to 156k in the previous NFP release. In common view, if the actual NFP figure misses expectations and comes around 156k or less, then the EUR/USD may continue its ongoing winning streak, putting the 1.1232 resistance zone in sight.